Analytics & Measurement for Accounting & CPAs: High-Impact Tactics That Win Now

by Design Delulu Editorial · September 24, 2025

In today's competitive accounting landscape, data-driven decision making isn't just an advantage—it's essential for survival. Analytics and measurement for accounting and CPAs provide the foundation for understanding client behavior, optimizing service delivery, and driving sustainable growth. This comprehensive guide explores practical tactics that deliver measurable results, helping you win demand, improve user experience, and achieve consistent growth.

Why Analytics & Measurement Matter for Accounting Firms

The accounting industry has undergone significant digital transformation, with clients expecting more personalized, efficient, and transparent services. Without proper analytics and measurement systems, accounting firms operate blindly, making decisions based on assumptions rather than data. This approach leads to missed opportunities, inefficient resource allocation, and ultimately, lost revenue.

Smart analytics implementation allows accounting firms and CPAs to track every touchpoint in the client journey, from initial awareness to long-term retention. By measuring what matters, you can identify which marketing channels deliver the highest-quality leads, which services generate the most revenue, and where potential clients drop off in your conversion funnel.

Key Benefits of Implementing Analytics for Your Accounting Practice

Event and Ecommerce Tracking with GA4 and Server Tagging

Modern tracking goes beyond basic page views. With Google Analytics 4 (GA4) and server-side tagging, accounting firms can capture detailed user interactions, track conversions across devices, and maintain data accuracy even with increasing privacy restrictions. This setup enables you to understand exactly how potential clients interact with your website, which content resonates most, and where improvements are needed.

Server-side tracking provides enhanced data privacy compliance while ensuring accurate attribution. For accounting firms handling sensitive financial information, this approach demonstrates your commitment to data security while maintaining the insights necessary for growth.

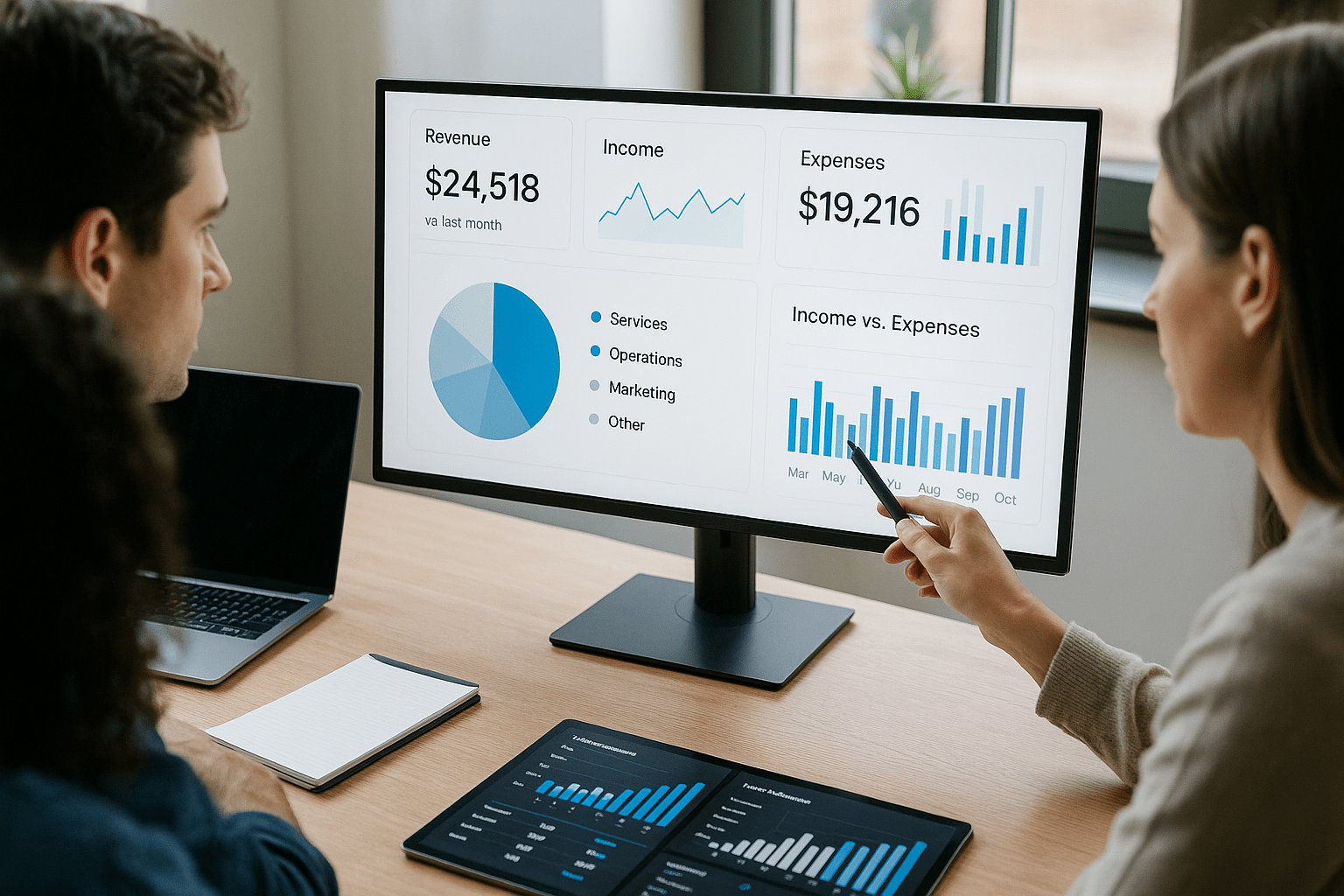

Source-of-Truth Dashboards in Looker Studio

Centralized reporting eliminates the confusion of scattered data sources. Looker Studio dashboards provide real-time visibility into your firm's performance, combining data from multiple platforms into cohesive, actionable insights. These dashboards can track everything from lead generation and client acquisition costs to service profitability and team productivity.

Custom dashboards tailored to accounting practices can include metrics such as client lifetime value, seasonal revenue patterns, service-specific conversion rates, and referral tracking. This centralized approach ensures all stakeholders access the same information, leading to more aligned decision-making.

Attribution Modeling That Matches Your Funnel

Accounting services often involve longer sales cycles with multiple touchpoints. Proper attribution modeling helps you understand the complete customer journey, crediting each interaction appropriately. This insight is crucial for budget allocation, as it reveals which marketing activities truly drive conversions rather than just last-click interactions.

For accounting firms, attribution modeling might reveal that educational content consumed months ago ultimately influenced a client's decision to engage your tax services, helping you better understand the value of different content types and marketing channels.

Governance for Consistent, Clean Data

Data governance ensures accuracy and consistency across all measurement initiatives. Without proper governance, teams may track events differently, leading to conflicting reports and poor decision-making. Establishing clear protocols for data collection, naming conventions, and quality assurance creates a reliable foundation for all analytics efforts.

Implementation Framework: How It Works

1. Discovery & Goals: Setting the Foundation

The first phase focuses on clarifying outcomes, understanding constraints, and defining success metrics. This involves comprehensive stakeholder interviews, competitive analysis, and current-state assessment of existing analytics capabilities.

Key activities include identifying primary business objectives, mapping the current client journey, documenting existing data sources, and establishing realistic timelines. This foundation ensures all subsequent work aligns with actual business needs rather than generic best practices.

2. Blueprint: Strategic Planning and Architecture Design

The blueprint phase translates business requirements into a technical implementation plan. This includes designing the measurement strategy, selecting appropriate tools and platforms, and creating detailed specifications for tracking implementation.

The blueprint covers data architecture design, event taxonomy creation, dashboard wireframing, and integration planning. This comprehensive planning phase prevents costly changes during implementation and ensures scalability for future needs.

3. Build & Launch: Implementation and Quality Assurance

Implementation brings the blueprint to life through systematic deployment of tracking codes, dashboard creation, and system integration. Quality assurance testing ensures accurate data collection before launch, preventing data quality issues that could compromise decision-making.

This phase includes GA4 configuration, server-side tag implementation, dashboard development, and comprehensive testing across devices and browsers. Documentation and training materials are created to support ongoing management.

4. Optimize: Continuous Improvement and Iteration

The optimization phase focuses on iterating based on data insights, identifying improvement opportunities, and doubling down on successful tactics. This ongoing process ensures your analytics implementation continues delivering value as your business evolves.

Regular optimization activities include performance review meetings, A/B testing of key pages and processes, dashboard refinement, and strategic planning based on emerging trends in your data.

Deliverables: What You'll Receive

Comprehensive Tracking Plan

A detailed tracking plan documents all events, conversions, and custom dimensions to be measured. This living document serves as the blueprint for implementation and ongoing maintenance, ensuring consistency across your team and any external partners.

GA4 and Server-Side Setup

Complete configuration of Google Analytics 4 with enhanced measurement capabilities, custom events, and conversion tracking. Server-side tagging implementation provides improved data accuracy and privacy compliance while future-proofing your measurement stack.

Custom Dashboards

Tailored dashboards in Looker Studio provide real-time visibility into key performance indicators. These dashboards are designed specifically for accounting firms, featuring metrics like client acquisition costs, service profitability, seasonal trends, and lead quality scores.

Attribution Model Configuration

Properly configured attribution models ensure accurate credit assignment across your marketing channels. This setup helps you understand the true impact of different touchpoints in your client acquisition process.

Best Practices for Analytics Success

Prioritize High-Impact Pages and Flows

Not all pages require the same level of tracking sophistication. Focus initial efforts on high-impact areas such as service pages, contact forms, and key conversion paths. This approach delivers faster results while establishing the foundation for broader implementation.

High-priority areas for accounting firms typically include consultation request forms, service comparison pages, case study content, and pricing information. These pages directly influence client decisions and provide the most actionable insights.

Pair Creative Assets with Measurement Strategy

Every marketing asset should have associated KPIs and measurement protocols. Whether it's a blog post about tax planning or a video explaining your audit services, clear measurement objectives ensure you can evaluate effectiveness and optimize performance.

This approach extends to all content types, from social media posts and email campaigns to webinars and downloadable resources. By establishing clear measurement criteria upfront, you can continuously improve content performance and ROI.

Leverage Templates and Systems for Scalability

Standardized templates and systematic approaches enable rapid scaling of successful tactics. Document proven processes, create reusable assets, and establish clear workflows that team members can follow consistently.

Template libraries might include dashboard layouts, tracking plan formats, testing protocols, and reporting structures. This systematization reduces implementation time while ensuring quality consistency.

Implement Regular Review Cycles

Consistent review cycles ensure your analytics implementation continues delivering value. Weekly tactical reviews focus on immediate optimizations, while quarterly strategic sessions address broader trends and opportunities.

These review sessions should include performance analysis, competitive insights, emerging opportunity identification, and strategic planning. Regular reviews prevent analytics implementations from becoming stagnant and ensure continuous improvement.

Industry-Specific Strategies for Accounting Firms

Map Search Intent to Buyer Journey Stages

Understanding how potential clients search for accounting services at different stages of their journey enables more effective content and measurement strategies. Early-stage searches might focus on general tax questions, while late-stage searches involve specific service comparisons.

Mapping search intent helps you create targeted content that addresses specific needs while implementing appropriate tracking to measure effectiveness at each stage. This approach improves both user experience and conversion rates.

Leverage Social Proof and Outcomes Early

Accounting services are trust-based decisions where social proof plays a crucial role. Implementing tracking around testimonials, case studies, and outcome demonstrations helps you understand which proof points most effectively influence potential clients.

Early presentation of social proof elements, combined with proper measurement, allows you to optimize their placement and messaging for maximum impact. This strategy is particularly effective for accounting firms where trust and credibility are paramount.

Establish Single Source of Truth Reporting

Multiple data sources can create confusion and conflicting insights. Establishing a single source of truth dashboard ensures all stakeholders work from the same information, improving decision-making alignment and reducing time spent reconciling different reports.

This centralized approach is especially important for accounting firms where accuracy and consistency are core values. Your measurement approach should reflect these same principles.

Embrace Rapid Testing and Iteration

Small, frequent tests compound into significant improvements over time. This approach allows you to continuously optimize performance while minimizing risk and resource investment.

Testing priorities for accounting firms might include consultation request form optimization, service page messaging, pricing presentation, and content distribution strategies. Rapid iteration based on data insights accelerates improvement and competitive advantage.

Key Performance Indicators for Accounting Firms

Revenue-Related Metrics

Primary KPIs should align with revenue generation, including lead volume and quality, qualified pipeline development, and actual sales conversions. These metrics provide direct insight into business impact and ROI.

Revenue-related KPIs for accounting firms typically include cost per lead by service type, lead-to-client conversion rates, average client value, and client lifetime value. These metrics enable accurate ROI calculation and budget optimization.

Channel Performance Indicators

Supporting metrics help you understand which marketing channels and tactics drive the best results. Channel-specific KPIs might include organic search rankings, paid advertising performance, referral tracking, and content engagement metrics.

Understanding channel performance enables more effective budget allocation and helps identify opportunities for expansion or optimization. This insight is crucial for sustainable growth in competitive markets.

Operational Efficiency Metrics

Analytics can also improve internal operations by tracking metrics such as service delivery efficiency, client satisfaction scores, and team productivity indicators. These operational insights support overall business optimization beyond just marketing performance.

Frequently Asked Questions

How Long Does Analytics Implementation Take?

Most comprehensive analytics implementations for accounting firms require 4-8 weeks, depending on complexity and feedback cycles. This timeline includes discovery, planning, implementation, testing, and optimization phases.

Factors affecting timeline include current system complexity, custom tracking requirements, dashboard customization needs, and team availability for reviews and testing. Rushing implementation often leads to data quality issues that are costly to fix later.

What Should Accounting Firms Track First?

Begin with revenue-related metrics such as lead generation, qualified pipeline development, and sales conversions. These primary indicators provide immediate business value and justify further analytics investment.

Supporting metrics can be added progressively, including channel performance, content engagement, and operational efficiency indicators. This phased approach ensures quick wins while building toward comprehensive measurement capabilities.

How Do Privacy Changes Affect Accounting Firm Analytics?

Privacy regulations and browser changes require more sophisticated measurement approaches, including server-side tracking and first-party data strategies. These changes actually benefit accounting firms by demonstrating commitment to data privacy while maintaining measurement capabilities.

Proper implementation of privacy-compliant measurement systems can become a competitive advantage, as potential clients increasingly value data security and privacy protection.

Getting Started with Analytics Implementation

Implementing effective analytics and measurement for your accounting practice doesn't have to be overwhelming. Start with clear objectives, prioritize high-impact areas, and build systematically toward comprehensive measurement capabilities.

The key is beginning with solid foundations and expanding strategically based on data insights and business needs. This approach ensures sustainable growth while maximizing return on your analytics investment.

Let’s level up your Accounting & CPAs Analytics & Measurement

Need analytics & measurement that actually moves the needle for accounting & cpas? See our approach, pricing, and timelines—then book a quick call.